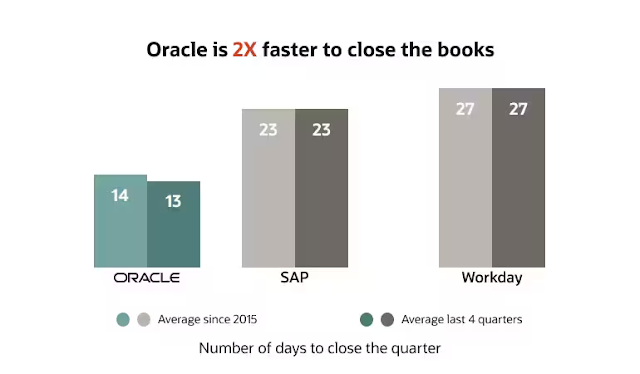

Oracle closes the books 14 days faster than Workday and 12 days faster than SAP per quarter. In a year, that is 56 days with Workday and 48 days with SAP you are leaving on the table. Imagine what your finance team could accomplish with 48 more days in the year?

With the right data in your financial systems, not only can you close your books faster, but you can respond faster to changing demands and emerging opportunities in your business.

Figure 1. Average number of days to close the books every quarter since 2015. Source: Refinitiv Eikon.

To be fast and nimble, you need the right data, not more data

There’s a tendency among application vendors like SAP and Workday to assume that putting more data into financials applications is better. With data-driven innovation in mind, one could indeed think that more is better—the more data you have, the more you can analyze and the more intelligent your enterprise appears to be. But what is the optimal amount of data for Finance? Where do you store data that you don’t absolutely require in your financials system? What types of analyses are useful? How much data do you need to benefit from data-driven innovation?

Let’s investigate:

In financials, a traditional ledger key consists at minimum of these data elements:

- Company, depicting a whole or logical part of a corporation, legal entity, or organization

- Account, to record balances and organize financial information and reporting

- Center, a logical unit within your organization, like business unit, department or group

Organizations typically use more than just these three segments in their financials. Other examples of segments that are commonly used are project and product; most companies use about six segments. With Oracle Cloud ERP, the key can have 30 segments of 240 characters each. The total combined grouping of company, account, and center and the other segments you’ve defined is called a ledger. You can have as many ledgers as you like.

Oracle’s ledgers can also be put into a federated structure. That means that you have a structure of ledgers that may share some key data elements (like cost centers or accounts) but they can also have other independent data elements in their key. Each ledger can have its own:

- Accounting method

- Cost method

- Cost granularity

- Costing period

Maintenance is federated, so if you maintain the top ledger, the underneath ledgers can optionally inherit the updates from the top ledger. This way, you can have as many ledgers as you like, each with 30 segments, so theoretically an endless combination of key data elements in your financials.

Figure 2. The structure of the federated ledgers is graphical in Oracle Fusion Applications. Source: Oracle

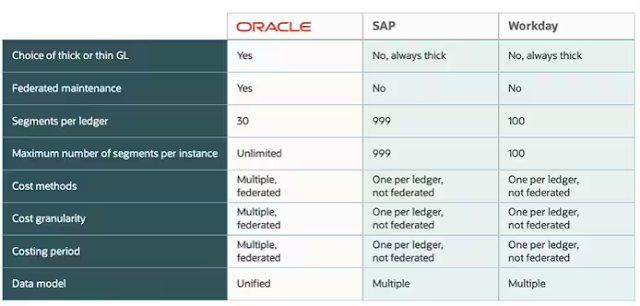

Oracle believes in being smarter and more structured with financials data. In contrast, SAP and Workday simply add more data in the hope that it makes the user smarter.

SAP. With SAP S/4HANA, SAP introduced what is called the “universal journal.” SAP extended the number of segments that the universal journal can hold. SAP S/4HANA now has a total of 999 segments in S/4HANA Financials, making up the ledger key. As a result, you can get “customers,” “sales campaigns” and “employee group” as ledger keys in SAP’s financials. Running financials with this many segments is referred to as a “thick GL,” meaning that it has more data than you need from an accounting point of view. In contrast, a “thin GL” has enough data for financial reporting, while other data is stored elsewhere in the suite of applications.

Workday. In essence, Workday does the same as SAP: it has a thick ledger, with more ledger keys than you need from an accounting point of view. The data elements are called Worktags, and you can have approximately 100 different types of Worktags. These Worktags make up the ledger key. As with SAP, you can get “customers,” “sales campaigns” and “employee group” as ledger keys in Workday Financials.

In a nutshell, this is how it compares:

Figure 3. How Financials compare. Sources: SAP S/4HANA Finance, an introduction”, Jens Krüger, Rheinwerk Publishing and “Tales of the Cloud: The Story of Worktags,” Workday blog, 2012.

Get smarter and more efficient with the right data

To work smarter with all the data in your organization, close your quarterly periods faster and speed up the decision-making process, consider these steps:

- Deploy machine learning (ML) techniques. The more data that is introduced to intelligent agents, the more accurate it becomes. But that doesn’t mean that you need to move more data into financials; ML can learn from data anywhere in your Oracle enterprise applications. It can even learn from data outside of Oracle Applications. ML also learns from how people interact with data, so that ML can personalize the response. ML doesn’t just look at how people handle data in financials, but again, anywhere in your Oracle enterprise applications.

- Use real-time data from their source. You already have sales data in your customer experience applications, employee data in human capital management, supply chain data in supply chain management and financial and planning data in ERP. Oracle also provides a semantic data model in Oracle Fusion Analytics Warehouse (FAW) to make end-users self-sufficient; they can interact with data in all those applications using commonly understood business terms in their respective source systems, without depending on IT.

Consider upcoming scenarios. React faster to upcoming changes with timely financial views of the business with the packaged KPIs, scenarios, visualizations and analytics dashboards in

- FAW, built on Oracle Analytics Cloud and the Oracle Autonomous Data Warehouse. There is no database or data warehouse design, and no tuning, data loading (ETL), or modeling; you just turn it on. Optionally, you can even include additional data from other applications and start creating scenarios.

- Enforce accounting policies. Oracle Cloud Financials is the single repository of accounting logic. This single set of accounting rules transform transaction information from external systems to meet statutory, corporate, regulatory, and management reporting needs. With centrally maintained accounting rules, you’ll prevent errors and need to make fewer corrections in your financials.

- Drill back to the source, don’t copy it. Keep industry-specific detailed transactional data in the source system, like high-volume billing data in the telecommunications or insurance industries. Let Oracle Fusion Cloud Accounting Hub (part of Oracle Cloud Financials) harmonize the data and send the result to your financials. Drill back to the source when you need more details.

Source: oracle.com

0 comments:

Post a Comment