For as long as financial services companies have existed, criminals have tried to defraud them of their earnings. In today’s world, this game of company-versus-fraudster has become more complicated than ever. Criminals are savvier, more inventive, and more audacious, and financial services firms see their reputation and massive fines are on the line.

More Info: 1Z0-071: Oracle Database SQL

But with graph databases, financial services firms have an effective weapon they can use in this ongoing battle. Because no matter how hard they try, financial criminals are often linked by relationships—whether it’s relationships to other criminals, locations, or of course, bank accounts. Graph databases, which make it easier to discover insights into relationships, take advantage of this fact to unfold new possibilities in the financial services world.

Here are just a few examples of use cases that graph databases can address.

Download the free ebook on graph database use cases

Graph database use case: Money laundering.

The problem

Conceptually, money laundering is simple. Dirty money is passed around to blend it with legitimate funds and then turned into hard assets. This is the kind of process that was used in the Panama Papers analysis. More specifically, a circular money transfer involves a criminal who sends large amounts of fraudulently obtained money to himself or herself—but hides it through a long and complex series of valid transfers between “normal” accounts.

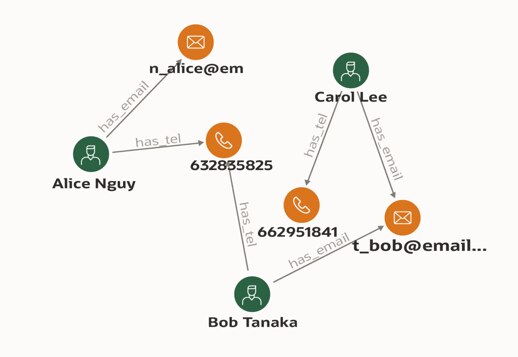

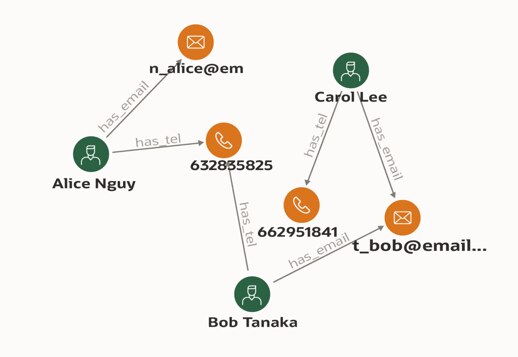

These “normal” accounts are actually accounts created with synthetic identities. They typically share certain similar information because they are generated from stolen identities (email addresses, addresses, etc.) and it’s this related information that makes graph analysis such a good fit to make them reveal their fraudulent origins.

The graph solution

To make fraud detection simpler, users can create a graph from transactions between entities as well as entities that share some information, including the email addresses, passwords, addresses, and more. Once a graph is created, running a simple query will find all customers with accounts who have similar information, and reveal which accounts are sending money to each other.

Graph database use case: Detecting money mules and mule fraud

The problem

Mule fraud involves a person, called a money mule, who transfers illicit goods. This can involve drugs but when it comes to the financial industry, usually involves money. The money mule transfers money to his or her own account, and the money is then transferred to another scam operator who is usually in another country. Traditionally, rule-based models create alerts and the suspicious accounts are flagged by humans. Machine learning is also used to predict human decisions. However, it is often difficult to improve the models because the accounts themselves usually have limited information.

The graph solution

This is where graphs come in. With graph technology, users can take the transaction information as edges and generate more features of the accounts based on surrounding relationships and transactions. For example, by using graph-based centrality scores, users can determine how close certain accounts are to known mule accounts.

In addition, these false accounts often share similar information (such as address or telephone numbers) because such information is necessary for registering the accounts—and the criminals only have so many identities to draw from. By using graph-based queries, graph users can quickly discover the accounts with similar relationships or the accounts involved with patterns like circulation and flag them for further investigation.

Through this method, graph technology can enhance machine learning models trained to discover money mules and mule fraud.

Graph database use case: Real-time fraud detection

The problem

In today’s world, consumers demand instant access to services and to money transfers—which opens up opportunities to criminals. For example, payment services apps try to deliver money as quickly as possible to valid users while also ensuring money isn’t sent for illicit purposes or hiding the real receiver by getting sent in circuitous routes. This necessitates real-time fraud detection.

The graph solution

Because graphs enable lightning-fast answers to queries and because they expand access to data, they have become a popular technology in the realm of real-time fraud detection. When investigating transactions with graph technology, it’s not only the transactions that can be modeled in graphs. Graphs are extremely flexible, which means the heterogeneous surrounding information can also be modeled. For example, client IP addresses, ATM geolocation, card numbers, and account IDs can all become vertices, and the connections can all become edges.

Property graph is often used for fraud detection, especially in online banking and ATM location analysis because users can design the rules for detecting fraud based on datasets. For example, detection rules can be set up for:

◉ IPs which log in with multiple cards registered in different places

◉ Cards used in different places with very far distances

◉ Accounts receiving one-time inbound transactions from other accounts registered in various places

These rules can be applied real-time because Oracle’s graph technologies can:

◉ Keep graphs updated and synchronized to the original relational table dataset

◉ Run high-performance queries and algorithms.

Source: oracle.com

0 comments:

Post a Comment