In a previous blog, we’ve looked at 4 ways retailers can harness disruption with Oracle Autonomous Database. Let’s now turn our attention to the financial services industry.

Time is running out for traditional banking. The past decade’s Fintech phenomenon, as a pool of agile innovation, has changed banking forever. Technology giants have also been working to unbundle financial services, and they tend to be very effective at managing customer profiles as well as anticipating preferences and spending patterns.

Powerful forces are reshaping the banking industry

The effects of the global pandemic are going to impact the financial services industry for years to come. Some will embrace emerging technologies and in time become stronger, while market entrants with innovative business models will push out less-nimble incumbents.

The exponential increase in available data is fueling new products and creating new opportunities. Critical to success is the ability to manage and harness all that data. While it’s essential to extract insights in order to grow, financial institutions are also mining insights to protect themselves from harm. Digitally native criminals are more sophisticated than ever, and rooting them out requires at least equally sophisticated systems.

A recent report from Omdia shows that modernizing legacy systems is the #1 IT priority of financial institutions to increase their ability to innovate. Indeed, modern technologies enable both incumbent institutions and new competitors to address challenges they’re facing as well as seize new opportunities. How? Let us look at a few customer stories illustrating 5 ways you can benefit from Oracle Autonomous Database.

1. Boost marketing and sales effectiveness – improving conversion rates by 40% and reducing churn by 3X

Up Sí Vale is a leading provider of payment and other financial services to 16,000 companies and 5 million consumers across Mexico. Its services include payment tickets for food, travel, and fuel as well as prepaid cards, digital wallets, and loyalty programs. Up Sí Vale needed to centralize information and streamline data analysis in order to learn more about its diverse sets of customers, but it wanted to do so quickly and with minimal disruption to its operations.

The company chose Oracle Autonomous Data Warehouse and Oracle Analytics Cloud because they were easy to set up, implement, integrate with other applications, and operate without database administration. Up Sí Vale found that the combination of Oracle Autonomous Data Warehouse and Oracle Analytics provided more flexibility, higher performance, and better integration with its applications than Snowflake did.

What results did Up Sí Vale achieve?

◉ Consolidated data management of 240 million transactions from 10 sources

◉ Eliminated 90% of the time spent on database administration

◉ Implemented Autonomous Data Warehouse companywide within three months, setting up new instances in less than 5 minutes

◉ Eliminated 75% of the time it took to assemble data in spreadsheets, allowing for more strategic customer segmentation and personalized marketing

◉ The sales team can now take a more proactive approach with customers, helping to reduce churn from 15% to 5%

Autonomous Data Warehouse intelligently automates provisioning, configuring, securing, tuning, and scaling a data warehouse. This eliminates nearly all the manual and complex tasks that can introduce human error. DBAs can shift their time from routine database administration to innovation and helping business departments to achieve their goals. Autonomous Data Warehouse auto-scales on demand, accommodating Up Sí Vale’s 40% ecommerce growth since the start of COVID-19 pandemic.

Aon was another organization in dire need of improving data management to boost marketing and sales effectiveness. Headquartered in London, Aon is a global professional services firm providing a broad range of risk, retirement and health solutions. Having grown over the years through several acquisitions, Aon needed to consolidate its silos of sales and marketing data to get a single view of its clients and prospects. It also needed a more robust analytics platform.

By moving its data reporting and analytics capacity from a variety of sources to Oracle Autonomous Data Warehouse and Oracle Analytics Cloud, Aon boosted performance by 50X to 60X. Response times to complex sales queries from 500 power users are now much faster, and the company estimates that its analytics costs are significantly lower than with its on-premises business intelligence tools. Autonomous Data Warehouse is saving Aon’s sales operations analysts 15 hours per week now that they don’t have to manually extract data, and it has enhanced the security of confidential sales information.

By eliminating data silos and adding robust analytics and reporting, Aon gained visibility into client-facing activities within and across departments, as well as deep insights for better targeting and cross-selling. Sales teams can now easily visualize business trends, outliers, client sentiment, and sales performance.

“We can provide insights with the push of a button across all of our regions, all of our solution lines, something that we have never, ever been able to do before.”

Teffani Zadeh, CIO, Growth Enablement and North America IT at Aon

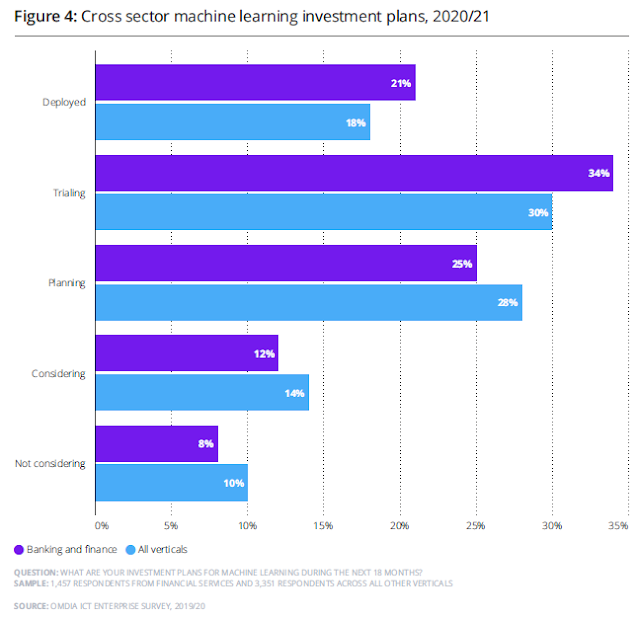

Let’s consider a final example in this section. According to the aforementioned Omdia report, financial institutions are more rapidly implementing Machine Learning when compared to other industries.

Banco Bilbao Vizcaya Argentaria (BBVA) is one of the largest financial institutions in the world. The bank collaborated with Oracle Consulting to develop a new Behavioral Economics Learning Algorithm, a system based on Oracle Machine Learning with Oracle Transaction Processing, to identify the cognitive mechanisms that are most relevant when generating a marketing campaign for different targets. BBVA obtained the following results:

◉ In Colombia, for example, too much online information was causing cognitive overload and browse abandon. By rectifying the wording and visuals of the offer, BBVA Colombia saw a huge uptake in applications for credit cards and online banking accounts.

◉ Across geographies, marketing campaigns generated through machine learning produced a 30% to 40% improvement in click-through and conversion rates

◉ Creatives that took days or weeks for agencies to work on are now finalized in a matter of minutes

◉ By using natural language programming, the system itself suggests now the optimum campaign content per target segment and mobile device, and auto-evaluates the probable results. It replaced pre-testing that was based on time-consuming random trials or opinion polls.

Autonomous Database accelerates the creation of Machine Learning models by eliminating the need to move data to dedicated Machine Learning systems. Oracle Machine Learning provides a collaborative interface for data scientists and analysts, with access to 30+ in-database parallel, scalable Machine Learning algorithms.

2. Improve fraud detection – with lower costs and higher performance than Amazon Redshift

AsiaPay’s digital payment gateway processes payments for multiple currencies, languages, channels, and devices across 15 countries. Thanks to this strength in cross-border transactions, the Hong Kong-based company serves many international retailers that prefer to standardize on a single payment flow vendor.

AsiaPay is experiencing huge growth. With that demand comes an ocean of Internet of Things data, including from mobile and touchscreen devices. A single transaction may offer more than 100 data points detailing location, bank balance, biometrics, and more, which can all be analyzed for fraud detection. For example, AsiaPay’s fraud detection analysis map may show an order payment with an IP address in Taiwan, an issuing bank in the Philippines, and a delivery address in Malaysia. Machine learning built into Oracle Autonomous Database can score this transaction as risky and warn the merchant.

“With Oracle Autonomous Data Warehouse, we can utilize AI to distinguish trade risk in real time.”

Joseph Chan, CEO and Founder, AsiaPay

Improving fraud detection was also critical for Ripley. Ripley is a leading retailer and credit card bank with 10 million customers across 60 stores in Chile and Peru. To better prevent fraud, Ripley consolidated 10 different data systems into one centralized unified system with Oracle Autonomous Data Warehouse, representing a single source of truth for actionable intelligence.

Autonomous Data Warehouse delivered significant benefits vs Amazon Redshift:

◉ 25% lower costs

◉ 2X higher performance

◉ 40% faster time to market

With zero database maintenance and less training for both developers and business users, Ripley can spend more time on innovation.

“Autonomous innovation is a competitive advantage to attract talent for data science and analytic engineers, and that is great for Ripley”

Andres Peralta, Data and Analytics Manager, Ripley

3. Enable Fintech operations – accelerating time to market while reducing costs by 15%

Strands enables banks to process huge amounts of information to build models for each customer, based on transactions, balances, and the customer’s input. Those models provide insights to help people make better decisions about their money, and about using the right financial products. Key to expansion is Strands’ aggressive use of the cloud to run its artificial intelligence-based platform, which it now offers as software as a service, in addition to its traditional on-site systems running in a bank’s own data center.

An essential piece of the Barcelona-based company's SaaS platform is Oracle Autonomous Transaction Processing running on Oracle Cloud Infrastructure. The database stores the vast quantities of data required to build, tune, and deploy machine-learning models. Strands' SaaS solution requires less effort for its customers to implement and integrate with digital banking than its previous on-premises software. This means banks can launch the service and get the capability in front of customers much faster. Strands' operating costs decreased by 15 percent using Oracle Autonomous Database.

Another Fintech leader is Veritrans in Japan, providing secure payment systems in-store and online. The company relies on Autonomous Transaction Processing to guarantee the high performance, availability and security of their solution. Autonomous operations enabled Veritrans to increase operational efficiency while reducing costs.

Autonomous Database uses continuous query optimization, table indexing, data summaries, and auto-tuning to ensure consistent high performance even as data volume and number of users grows. Autonomous scaling can temporarily increase compute and I/O by a factor of three to maintain performance. Unlike other cloud services which require downtime to scale, Autonomous Database scales while the service continues to run.

4. Bridging the financial divide – reducing query time from hours to minutes and doubling conversion rates

In India’s ultracompetitive banking industry, Federal Bank stands out with a mix of branch-based banking options and feature-rich mobile applications that appeal to on-the-go customers. Its success also comes from understanding the Indian banking customer’s unique needs, from offering gold-backed loans to individuals, to low-cost packages for small and medium business, to complex financial packages for enterprise customers.

Knowing just what to offer takes insight. With Oracle Autonomous Database and Oracle Analytics Cloud, Federal Bank now has a self-driving database with increased performance and stability, plus the security demanded of financial systems. Machine learning in Oracle Autonomous Data Warehouse was able to halve the time required to run certain queries on customer data, empowering management with actionable intelligence for faster decision-making.

“For us, analyzing and understanding customer data is the bread, butter, and jam of everything we do as we look at future decisions. Oracle Autonomous Database is at the core of that.”

Shalini Warrier, Executive Director, Federal Bank

Also acting to bridge the financial divide is Forth Smart. In rural Thailand, cash is king. Salaries are paid and rent is handed over in bills and coins. Markets, restaurants, taxis, and buses all expect cash. Yet nearly everyone also carries a mobile phone, and Forth Smart provides kiosks that connect the digital and cash economies. Its 120,000 kiosks let people use cash and coins to top off prepaid mobile phones and transfer funds between friends and relatives. They additionally offer a greatly expanded number of services and ebanking functions. And with more than 15 million users, the kiosks have become prime real estate for advertisements and offers for internet packages.

Forth Smart needs real-time insight into customer behavior on its kiosk network, which handles more than 2 million transactions a day. To get that insight, while also securing the data, Forth Smart uses Oracle Autonomous Data Warehouse, and Oracle Analytics Cloud without a database administrator. They apply machine-learning algorithms to understand customer segments and predict how an offer will fare, resulting in doubling the ad conversion rate.

“Using Autonomous Database with Oracle Machine Learning inside, we were able to reduce query time from three hours to minutes, and increase our customer ad conversion rates by 2X to 3X. This allows us to better utilize our marketing budget and effort.”

Pawarit Ruengsuksilp, Business Development Analyst, Forth Smart

5. Fostering a data-driven culture – delivering key insights across numerous data sources in less than 2 seconds

Generali is one of the largest insurance companies worldwide. Its HR departments compiled data manually in templates, and sent those templates to the head office team for reporting and analysis purposes. This approach was time-consuming and susceptible to errors. Generali needed a more efficient, reliable, and automated process.

The goal was to find a solution that would increase a data-driven mindset across Generali’s HR community, a shift that would have a long-term ripple effect of increasing efficiencies, correlating HR patterns for better decision-making, supporting diversity & inclusion, and automating reporting and key metrics analysis that focus on improving the overall HR function and employee engagement.

Generali chose Oracle Autonomous Data Warehouse and Oracle Analytics Cloud as its best option to improve reporting performance, to easily scale the solution in case of footprint enlargement or increasing capacity needed during peak usage, and for integration with Generali’s existing Oracle HCM solution.

Oracle Autonomous Data Warehouse and Oracle Analytics Cloud transformed Generali’s reporting process, empowering HR with direct access to more accurate information. The streamlined and automated reporting process allowed HR staff to be more productive and focused on value-adding activities rather than overwhelmed with reporting tasks.

Generali HR and executives get key insights and measures about employee management, integrating data from different sources. Generali also created an executive dashboard to monitor and measure strategic HR KPIs, with the convenience of accessing key information on mobile devices.

Machine learning in Oracle Autonomous Data Warehouse tunes itself to increase reporting speed even while Generali increases data volumes. Now, HR users experience a quicker reporting response time of fewer than 2 seconds due to the performance improvement. Generali also benefits from autoscaling the autonomous database on demand, increasing capacity for greater performance during peak reporting periods, and decreasing capacity to save costs.

Overall, Generali’s HR community has embraced a more analytical culture, supporting the decision-making process with meaningful and easy-to-use workforce analytics.

Source: oracle.com

0 comments:

Post a Comment