Unifying and consistently maintaining accurate accounting data for the purpose of analysis and reporting is a formidable challenge when dealing with multiple source applications and large volumes of data. Nonetheless, it is a necessary requirement for business agility, regulatory compliance, company growth, and maintaining a competitive advantage.

The introduction of Accounting Hub Analytics within Oracle Fusion ERP Analytics empowers finance organizations to establish a comprehensive system of insights for accounting data. This data is drawn from Oracle Accounting Hub sub-ledger applications, enabling organizations to gain valuable insights from both operational and financial data. Furthermore, the integration of data from Accounting Hub sub-ledger applications with the broader Oracle Fusion Cloud ERP application data forms a robust foundation for in-depth analysis.

Uncover operational and financial data connections

Accounting Hub acts as a bridge to general ledger (GL) data from diverse transactional sources, while preserving transaction context through associated supporting references. This supporting reference information is stored in Accounting Hub but not transferred to GL, and these details are often necessary to unearth valuable operational and financial insights.

Accounting Hub Analytics enables you to discover meaningful correlations among balances, journals, and granular sub-ledger transaction details, bolstered by supporting references, which allows for the swift detection of irregularities with end-to-end traceability. This empowers organizations to enhance operational efficiency, sharpen their decision-making capabilities and guide them toward optimized outcomes.

Accounting Hub

Here are a few use cases on needs for Accounting Hub Analytics:

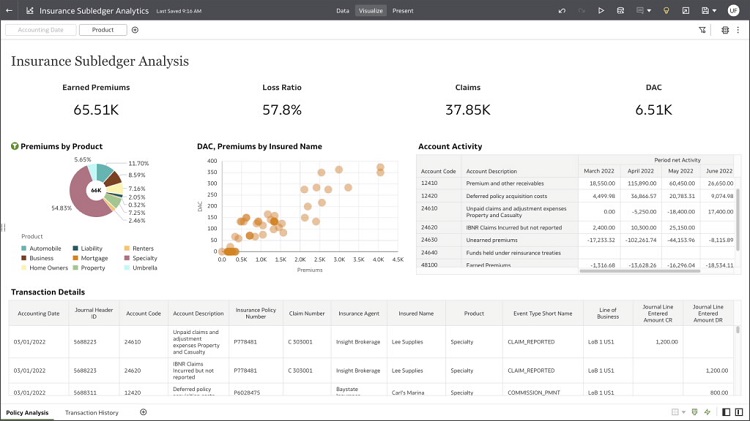

Industry specific analytics: Financial services companies aim to assess risk and profitability using data from various sources. With Analytics Hub Analytics, banks can analyze booking trends for mortgages, car loans, deposits, and other offerings based on supporting reference details. Insurance companies also require insights into auto, home, life, and other insurance businesses, enabling them to delve into granular details.

Enterprise analytics and reporting platform: Multinational companies often expand through acquisitions without centralizing IT operations in their new subsidiaries. This can lead to difficulties in providing comprehensive, accurate and timely enterprise-wide reports due to inconsistent reporting standards and data quality issues. By using Accounting Hub Analytics, organizations can leverage supporting references to reconcile management dimensions to create consolidated financial reporting.

Rapid Onboarding of Acquisitions: Consolidating IT functions after an acquisition can also leverage the advantages of Accounting Hub Analytics. Initially, upon acquiring a subsidiary, the Accounting Hub can facilitate the seamless integration of the subsidiary's legacy Chart of Accounts (COA) with the primary ledger's COA. Then Account Hub Analytics can provide various financial representations and reports, supporting the reconciliation process.

Create a system of insights for all accounting data

Here are a few use cases on needs for Accounting Hub Analytics:

Industry specific analytics: Financial services companies aim to assess risk and profitability using data from various sources. With Analytics Hub Analytics, banks can analyze booking trends for mortgages, car loans, deposits, and other offerings based on supporting reference details. Insurance companies also require insights into auto, home, life, and other insurance businesses, enabling them to delve into granular details.

Enterprise analytics and reporting platform: Multinational companies often expand through acquisitions without centralizing IT operations in their new subsidiaries. This can lead to difficulties in providing comprehensive, accurate and timely enterprise-wide reports due to inconsistent reporting standards and data quality issues. By using Accounting Hub Analytics, organizations can leverage supporting references to reconcile management dimensions to create consolidated financial reporting.

Rapid Onboarding of Acquisitions: Consolidating IT functions after an acquisition can also leverage the advantages of Accounting Hub Analytics. Initially, upon acquiring a subsidiary, the Accounting Hub can facilitate the seamless integration of the subsidiary's legacy Chart of Accounts (COA) with the primary ledger's COA. Then Account Hub Analytics can provide various financial representations and reports, supporting the reconciliation process.

Attain a cross-functional view of your business

By combining Accounting Hub data with other Oracle Fusion Cloud ERP data such as projects, general ledger, payables, and receivables, exploration can be enriched without complex data integration. Oracle Fusion ERP Analytics seamlessly integrates with other Fusion Analytics prebuilt analytical solutions designed for various Oracle Cloud Applications, including human capital management (HCM), supply chain management (SCM), and customer experience (CX) to create a unified analytical data model that spans multiple departments and incorporates prebuilt shared dimensions.

With Oracle Fusion ERP Analytics, you can easily import data from third-party sources, including operational and digital systems. That data can be combined with accounting data to discover intricate patterns and gain invaluable insights that drive transformative strategies and empower data-driven decision-making across multifaceted domains.

Source: oracle.com

0 comments:

Post a Comment